“When will I get money from the stimulus bill?” “How much money will I get?” “When will the money arrive?”

These three questions seem to be in the minds, hearts and souls of just about every American, in the wake of the Coronavius (COVID-19) global pandemic.

Because of the pandemic, Americans continue to file for unemployment benefits in record numbers.

Additionally, industries have had to shut down or completely dissolve. Life appears to be at a standstill.

In this post, we will answer those three questions, as well as more. We'll offer to provide useful information for you.

Understanding the Coronavirus Aid, Relief, and Economic Security Act

The Coronavirus Aid, Relief, and Economic Security Act which is also known as the CARES Act, is a law that addresses the economic discord and fallout due to the Coronavirus COVID-19) pandemic.

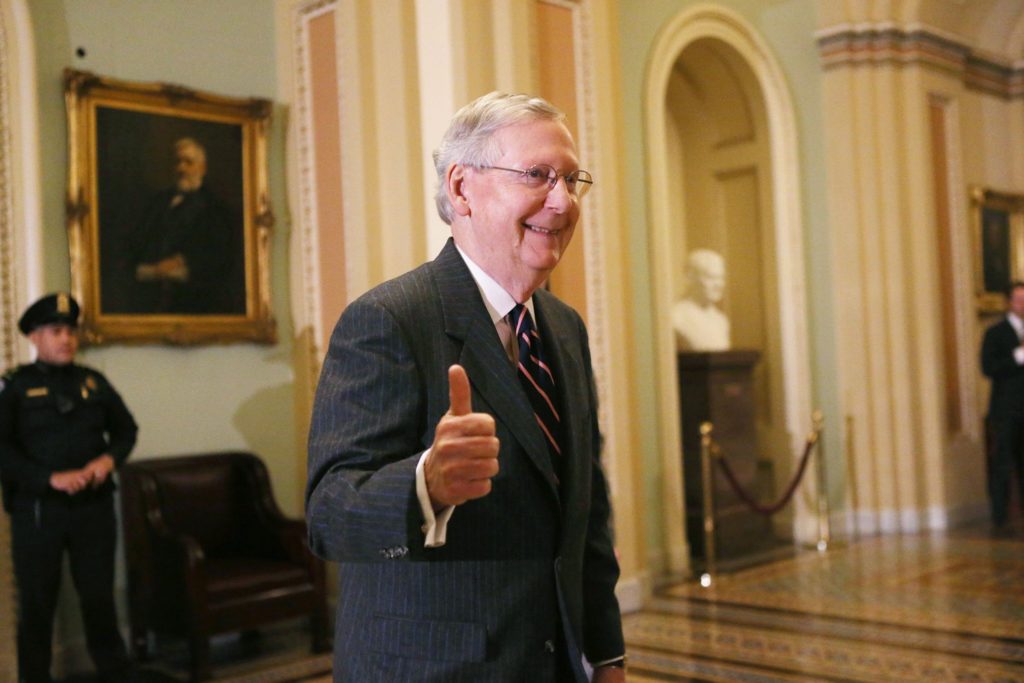

United States Senate by Majority Leader Mitch McConnell (R-KY) introduced the bill, which is now a law.

Important Facts to Know About the Coronavirus Aid, Relief, and Economic Security Act

- With its size, the legislation is now the largest-ever economic stimulus package ever.

- The original bill slates to offer $500 billion in direct payments to a lot of Americans.

- Negotiations took place and the bill now grows into a $2 trillion bill

- The United States Senate passes the bill on March 25, 2020.

- On March 26th, the United States House passes the bill.

- President Donald Trump signs the bill into law.

The Stimulus Bill & Economic Activity

With the onset and growth of the Coronavirus pandemic, world leaders as well as municipality leaders demand that citizens stay in their homes to stop the spread, or to “flatten the curve”.

Bushiness are completely closed and the economy is at a virtual standstill.

The stimulus bill is to help Americans pay bills, rent and meet financial obligations.

Leaders hope that the money that Americans get, will help to “jump start” the economy into an upward turn.

When are the first payments going to go out to Americans?

Those individuals who have direct deposit information on file with the Internal Revenue Service (IRS), will get the first wave of payments. This puts these payments made to people’s bank accounts in mid-April of 2020 or toward the end of the month.

Additionally, leaders state that an online portal will be set up for people to offer the details of their banking information, so they can see the money deposited into their checking or savings account. Whatever bank account the IRS has on file, is the bank account that will get the stimulus bill check/money.

For people who do not have direct deposit information on file with the IRS, those people can expert to see a check come though the United States Postal Service (USPS) in late April, through May of 2020. In other words, if the IRS has no banking information in file for you, you may get your paper check later in the spring.

If you have filed a tax return for the 2019 tax year, the IRS will use your 2019 tax return to submit your payment.

If you filed your 2018 return, the government will use that return to calculate the amount you will get.

The amount you get is based on the amount of income you reported to the US government.

Important points to know about your payment

- You will not have to pay taxes on the money you get from the stimulus bill.

- Anyone who owes back taxes will still get the payouts.

- Individuals can get up to $1,200.

- Couples can receive up to $2,400.

- Each child a person/ couple has, can get up to $500 per child.

- Payments will begin to dissolve for people who have incomes of more $75,000.

- For every $100 of gross income, the amount will be a reduction of $5.00

- People who make $99,000 will not get any stimulus money.

- The income thresholds are going to be doubled for couples.

Who is eligible for a stimulus payment?

The amount you'll receive depends on your total income in 2019 or 2018. If you qualify, you'll get one payment. Who qualifies for a payment?

-

- A single person, who is a US resident and you have a gross income less than $99,000.

- A person who has filed taxes as the head of a household and you made under $146,500.

- An individual who files jointly without children and you earn less than $198,000.

Your Stimulus Bill Money Payment and Your Direct Deposit

According to the IRS, payments will go out automatically to those individuals who give authorization for direct deposit for their tax refunds.

You must have this authorization for the 2018 and/or the 2019 return.

Therefore, you can look for your money into the same banking account that the IRS has on line.

You do not have to do anything to get your stimulus bill money.

According to reports, in 2019, about 92 million people got refunds via direct deposit.

But What if I Don’t Have Direct Deposit Set Up?

Officials say that you will be able to set up direct deposit, so that you can have your stimulus bill check sent to your bank account.

Secretary Mnuchin states that for those who don't have direct deposit set up but want to get their stimulus bill money sent electronically, the federal government will create an online system.

The system will allow you to receive electronic payments as opposed to a paper check. Therefore, you will get your money directly into a bank account.

According to the IRS, the online tool will be available toward the middle to the end of April. Click here to learn more!

Who has to take action, to see their stimulus bill payout?

First of all, if you didn’t file a 2018 or 2019 tax return, do that ASAP.

Secondly, if you generally don’t need to file a tax return, you may have to file one right now, in order to get your stimulus money payout.

You can all or email a tax professional to get a sound answer.

Even if you are a person who made less than $12,200 in 2019 or you and your partner or spouse made less than $24,400, you need to file a return to get a stimulus bill check.

What if I Get Social Security? Will I get a check from the stimulus bill?

The Treasury states that Social Security beneficiaries who generally don’t file a tax return will automatically get the $1,200 stimulus bill payment.

The announcement is a reversal from the previous statement from the IRS. Before, the Internal Revenue Service said everyone would need to file some sort of tax return, to get a stimulus bill check.

This is no longer the case. Even if you don’t normally file taxes, you can still get a stimulus bill check along with your Social Security payment.

Treasury Secretary Steven T. Mnuchin states that Social Security recipients who do not file a tax return do not need to do anything. You can just wait to receive your stimulus bill payment directly to your bank account. It will be given to you, in the same way you get your Social Security monthly payment.

If you're typically not required to file a tax return, you still can get a stimulus bill check!

But the IRS states that you will need to file a simple tax return to get the stimulus bill payment. Click here to file and learn more!

The IRS is setting up instructions for how to file a 2019 tax return. Soon, people can view information on its Coronavirus web page for filing a tax return, even if you don’t typically file a return. Click here to see the Coronavirus page!

I need to file a tax return and my tax preparer is closed.

How long can I get my stimulus check?

How long are the economic impact payments going to be available?

Lots of tax professionals or local community organizations are closed due to “stay in mandates.” Your stimulus check/payout will be available throughout the rest of 2020.

What can I do, if I don't receive my stimulus check?

If you qualify for a stimulus bill payment you can watch for a notice in the mail from the government. That notice will have information about your stimulus bill check.

So, if you get receive the notice but no direct deposit of money or even your check be sure to call the IRS. Make sure that you have your notice in your hand when you call.

How to get your stimulus check sooner

If you want to get your stimulus bill check quickly, tax preparers say you need to file your tax return ASAP.

When you do file, make sure you choose direct deposit. This way, the IRS has your banking information.

If you find difficulty in doing this, the IRS is setting up an online portal, where you can provide your bank’s routing and account number, so you can get your money. So, look for the online portal in late April or early May. Click here to be taken to the IRS page!

What if my payment is late or I don’t get it at all?

Chances are, you’re not going to see the money quickly.

Therefore, it’s best to be patient, even though bills are due.

But you can be on the lookout for your paper notice in the mail. This notice will outline the amount of money you will get from the stimulus bill.

Additionally, the IRS discouraging people to call them.

But they are asking people to check their coronavirus information page for updates regarding your stimulus check payment.

Unfortunately, the IRS has cut back on some of its services just like the rest of the country. They do have agents who are working remotely to help others.

As time progresses, you can expect to see changes to the IRS and their assistance.

Will I Have to Pay Taxes on My Stimulus Bill Money for the 2020 Tax Year?

No. Officials say that you will not owe taxes on the stimulus money you receive from the US government.

Five Points To Know About The COVID-19 Stimulus Bill Payments

Check out five things to know about the stimulus bill money.

Five Points To Know About The COVID-19 Stimulus Bill Payments

-

There are income requirements that have to be met to qualify for a check.

Keep in mind that there are three, dollar amounts to remember regarding the stimulus payments:

- you will get $1,200 as an individual taxpayer.

- You and your spouse or the person you are married to will get, $2,400 who file jointly.

- The country’s families will receive an additional $500 per qualifying child, who is under the age of 17.

-

If you don’t qualify for a check, based on previous tax returns, you can still qualify for a check, once you file your 2020 return.

There is a provision in the stimulus bill that outlines those who file a 2019 tax return but are now jobless will get a stimulus check. But you just won’t get it quickly.

If your income suddenly drops due to being jobless, or your income is low in previous years, you can claim the stimulus on your 2020 tax return.

Another point to remember is if you find and end up making more money in 2020 and end up in the phase-out section of income, you will not have to give back your stimulus check to the government.

-

You will get a notice, after the government sends your payment.

Stimulus checks will be sent to direct deposit. This is the bank account listed on 2019 tax returns If there is no bank account info, the IRS will send a physical check to your most recent address you have on file with them.

But if you have a change in address the IRS is developing a portal you can use to update your mailing address information. Click here to learn more from the IRS!

By law, the Treasury has to send you a notice to the last known address they have. Additionally, your mail notice will include a phone number for you to contact the IRS if you don’t get your stimulus payment money.

The IRS is working as fast as they can to provide payment, in the wake of the stimulus bill being passed. It will not be a quick process, but at least money is on the way, if you qualify.

And, if you do call the IRS, expect to be on hold for a while, depending when you call them.

-

Lots of college students will not qualify for a stimulus bill check.

One major drawback to the stimulus bill check payments, is anyone who falls under a dependent will not qualify for a payment. Lots of college students fall into this category.

As a result, lots of college students will, be ineligible for a stimulus check.

So, who is a dependent? By law, a dependent is a child under the age of 19 at the end of the year, who lives with a parent or guardian, half of the year.

A dependent is also a person who does not have at least half of his or her own support for the year. Click here to learn more about dependents from the IRS.

-

You owing money to the IRS should not affect your stimulus bill check payment.

If you owe the government money, you could still see a check! When you owe money to anyone especially the government, it is never a fun time. Generally, the government will garnish your wages or find a way to get what they are due.

And with this thinking, you may be pondering if you will get a stimulus check. But there is good news. More than likely, the IRS will not take your stimulus bill money away. The only time you may not see the stimulus bill money, is if you owe child support.

The IRS Warns About Coronavirus-related scams – Don’t Fall Prey to Online Hoaxes or Scams

Even in the midst of the worldwide global Coronavirus (COVID-19) pandemic, some folks find the time to scam others out of money.

Given such we found information directly from the IRS to protect you and your stimulus bill payment.

First and foremost, the IRS wants you to know that you should be on the lookout for LOTS of calls and email phishing scams, about Coronavirus, or COVID-19.

Please do not click weird links or pictures.

The IRS will NEVER send you an email!

These scams can not only be sent through email, but your phone too. Once you do click on those pictures or links, your personal information can be reviled and your money taken or lost to a scammer.

The IRS adds: “We urge people to take extra care during this period. The IRS isn't going to call you asking to verify or provide your financial information so you can get an economic impact payment or your refund faster.”

Even if you get an email that looks like it came from the IRS, don’t click any link or open any attachment. Why? It did not come from the IRS.

The IRS also adds: “Taxpayers should watch not only for emails but text messages, websites and social media attempts that request money or personal information.”

The IRS website also adds: “History has shown that criminals take every opportunity to perpetrate a fraud on unsuspecting victims, especially when a group of people is vulnerable or in a state of need.”

In a statement from IRS Criminal Investigation Chief Don Fort, he states: “While you are waiting to hear about your economic impact payment, criminals are working hard to trick you into getting their hands on it. The IRS Criminal Investigation Division is working hard to find these scammers and shut them down, but in the meantime, we ask people to remain vigilant.”

Criminals will still use phone calls to scare and scam others.

The criminal mind is a busy mind. So, you have to watch for phone calls. Check out some of the phrases they will use to threaten you:

- “This is the IRS. If you do not call us back, we will come to your home and arrest you immediately.”

- We are the IRS. This message is important. You must hold so we can give you important information.

- Attention! This is the IRS! We need to speak with you immediately regarding your stimulus check! Please hold to speak with our agent.

- You must contact the IRS with your credit card information immediately, to get your stimulus check!

All of these messages and those similar to them, are scams!

Warning Signs You are getting scammed on the phone!

- You are getting a phone call from the IRS – THE IRS WILL NEVER… NEVER CALL YOU! The IRS communicates mostly through the mail, even if you have delinquent taxes. Additionally, the IRS will generally make contact with you person only after you have gotten multiple written notices.

- You get a call from an IRS and they are threatening you to throw you in jail – Some criminals pretend to be IRS officials. They will demand immediate payment. Now, with folks getting stimulus checks, you will probably get calls threatening you, if you don't give your stimulus check to them. DO NOT FALL FOR IT! THE IRS WILL SEND YOU A NOTICE IN THE MAIL!

Be on the lookout from scammers looking to steal your stimulus payment!

The IRS does not want you to live in fear, but rather be cautious of people who will try to steal your stimulus payment. In fact they state: “IRS and its Criminal Investigation Division have seen a wave of new and evolving phishing schemes against taxpayers. In most cases, the IRS will deposit economic impact payments into the direct deposit account taxpayers previously provided on tax returns. Those taxpayers who have previously filed but not provided direct deposit information to the IRS will be able to provide their banking information online to a newly designed secure portal on IRS.gov in mid-April.”

The also add that if the IRS does not have a taxpayer's direct deposit information, that taxpayer will get a paper check in the mail with the address they have on file.

“Taxpayers should not provide their direct deposit or other banking information for others to input on their behalf into the secure portal,” adds the IRS.

Want to do a quick calculation of the approximate amount you will receive for your stimulus payment check? Click here!

Click here to read more about scams and how to protect your stimulus payment money from undesirable people!

We realize that we are in tough times right now. Help is on the way.

These tough times will no last forever, although it appears is if they will.